CHINA

The issue has come to a head as the Chinese economy has blossomed. China holds the majority of the known reserves of lanthanide elements and, understandably, would prefer to export high ‘added value’ products, rather than lower value raw materials. Some estimates

3 put China’s holdings at >90% of global reserves, and a political decision to reduce exports from China by 70% has inevitably pushed the price of these metals very high indeed. The British Geological Survey (BGS) produced an informative review

4 of these metals in 2010 on behalf of Minerals UK, and the Geological Society published a briefing note on the Rare Earth Elements in November 2011.

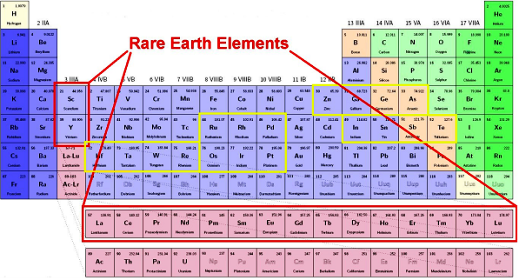

Rare Earth Elements comprise the lanthanides and the closely related metals scandium and yttrium, with which they are often associated in nature. Although some of them are not especially rare, there are few rich ores and many of those known outside China are in remote locations. To compound this awkward situation, the recycling of these metals is in its infancy.

Lithium is a more abundant element that is also not yet recycled effectively. When I visited the lithium operations of Umicore, in Olen, Belgium, our host asked a simple question: “What have you done with your old mobile phone?” Without exception, the visitors admitted that their old phones were lying in a drawer! Many expensive devices will be stored in this way at the end of their lives - in case they are needed - before they enter the recycling circuit, should such a circuit exist.

In nature, REEs occur in a wide range of minerals, often complex carbonates, phosphates, silicates and arsenates. Despite their name, they are not, in fact, all that ‘rare’. Cerium, for example, is about as abundant as copper in the Earth’s crust (~68ppm) but, unlike copper, is rarely concentrated into abundant ores. Their similar chemistries mean that the REE metals are notoriously difficult and expensive to separate from each other. At the time of writing the commonest REE, cerium, has a 99% spot price of around £90/kg. Metal prices are further complicated by rapidly evolving markets.